FARM COVERAGES

FARM-GUARD® FARM INSURANCE POLICY

We are your partner in protection.

Farmers know a thing or two about uncertainty. Serious injury or product contamination can send an otherwise smoothly running farm operation reeling. That’s why Grinnell Mutual offers Farm-Guard®, a farm liability policy that protects the members of your household in case of an accident, injuries, or claims of negligence. Even better? Farm-Guard® can be attached to your Farm-Mate policy issued by your member mutual or on its own. From premium discounts to optional coverages, Farm-Guard® will ensure that even if your today is hazy, tomorrow will be brighter.

FARM-GUARD® FARM INSURANCE LIABILITY COVERAGE*

- Medical payments to public — Pays for accidental injury to the public on your premises, by your livestock or because of your farming operations or personal acts

- Employers’ liability — If state law doesn’t require Workers’ Compensation, this coverage protects against liability for injuries suffered by your farm employees

- Medical payments to farm employees — Covers medical expenses for accidental injury suffered by your farm employees while on the job, even if you’re not at fault

AUTOMATIC FARM INSURANCE COVERAGES

- Coverage for losses arising out of custom farming or feeding when receipts total less than $5,000**

- Protection from losses arising from business pursuits, except agricultural spraying, when receipts total less than $2,000**

- Contractual liability relating to the farming operations, goods or products, or resident premises

- Personal injury protection against bodily harm, shock, or mental anguish

- Limited coverage for bodily injury caused by communicable disease via animals

** Higher limits are available

OPTIONAL FARM INSURANCE COVERAGES INCLUDE

- Business activities

- Residential rental property

- Home day-care provider

- Hunting and fishing

- Custom farming

- Custom feeding

- Broad contractual liability

- Agricultural custom spraying

IDENTITY THEFT PROTECTION

Grinnell Mutual understands that your most valuable commodity is your good name. That’s why we provide free access to fraud specialists at CyberScout™, a leader in identity management and fraud education.

Contact an agent to find out more about Farm-Guard® insurance.

*Farm liability coverages are not available in the state of Pennsylvania.

_________________________________________________________________________________________

AGRIBUSINESS

We stay ahead of the curve. Whether you’re a seed dealer or own a working ranch, we believe there’s no such thing as a “small” business — it’s a big deal to you and it’s a big deal to us. Grinnell Mutual understands that your livelihood needs tailored, focused coverage you can’t get from a basic agricultural package. And because we know that the rural marketplace is constantly evolving, we offer products that align with the latest in agriculture technology. It’s another way we’re is investing in tomorrow’s farmer.

COMMERCIAL AGRIBUSINESS INSURANCE COVERAGE

- Commercial buildings

- Business personal property

- Inland Marine

- Dwelling

- Personal structures

- Farm buildings

- Household personal property

- Machinery

- Equipment and implements

- Scheduled or unscheduled farm personal property (machinery, equipment, and implements)

OPTIONAL AGRIBUSINESS PROPERTY PLUS ENDORSEMENT

- Newly purchased farm machinery, vehicles, and equipment

- Additional 30 days borrowed or rented farm machinery

- Rental reimbursement on farm machinery

- Disruption of farming operations

- Tank leakage

- Cost of record restoration

- Farm computer and office equipment

- Disruption of farming operations

- Pollutant cleanup and removal

- Computer fraud

- Water backup

OPTIONAL AGRIBUSINESS LIABILITY INSURANCE COVERAGES

- Custom Farming Liability

- Custom Feeding Liability

- Confined Livestock Care, Custody, and Control Liability

Commercial Agribusiness coverage is available in Iowa, Illinois, Indiana, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota, and Wisconsin. All risks must be referred to Grinnell Mutual by the sponsoring agent’s mutual to verify the mutual’s role in the agribusiness account.

Contact an agent to find out more about Agribusiness insurance.

https://www.grinnellmutual.com/insurance/farm/farm-coverages

Announcing the Recipients of the 2023 Farmers Mutual Insurance Service Award Scholarship

Every year Farmers Mutual Insurance sponsors 20 college scholarships for high school seniors whose parents are policy holders and currently attend a local northwest Iowa high school. The purpose of this scholarship is to award those who have a record of academic excellence and service to their community.

We are proud to announce the following recipients for the 2023 Farmers Mutual Service Award Scholarship:

- Jadyn Jensen Sibley-Ocheyedan High School

- Emily TerWee West Lyon High School

- Avery Noble Boyden-Hull High School

- Derek Goth MMCRU High School

- Megan Van Maanen Trinity Christian High School

- Myka Schut Sioux Center High School

- Isabelle Olson MMCRU High School

- Jack Meister Woodbury Central High School

- Kaylee Fluit Central Lyon High School

- Brooklyn Vander Veen Unity Christian High School

- Beau Rasmussen South O’Brien High School

- Frankie Allender River Valley High School

- Leah Langel Gehlen Catholic High School

- Brandt Van Dyke Sioux City East High School

- Jaylee Happe Cherokee Washington High School

- Avery Schroeder Kingsley-Pierson High School

- Hayden Van De Stroet Western Christian High School

- Hannah Pigott Cherokee Washington High School

- Madison Theisen Alta-Aurelia High School

- Kourtney Dekker Sheldon High School

We at Farmers Mutual would like to say congratulations to these astounding high school seniors and wish them the best on their future college endeavors!

Service Line Coverage

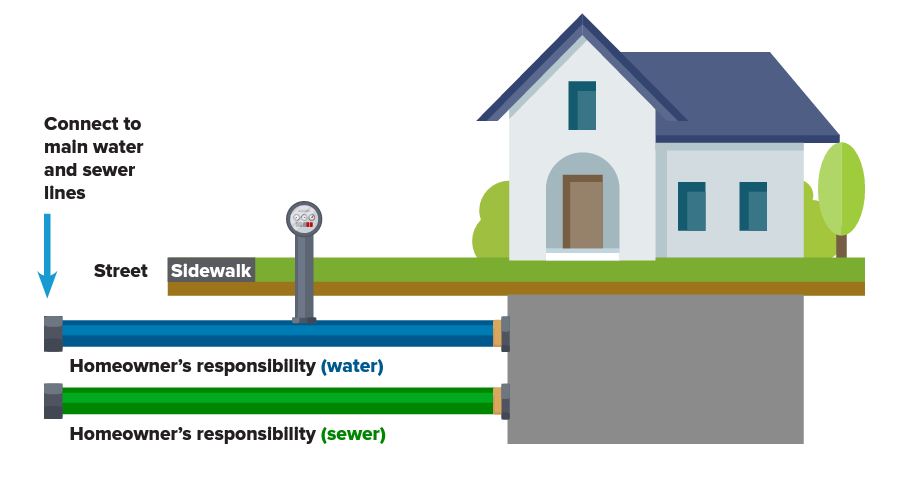

The main utilities running to you and from your home are not something you normally think about until you have a problem with one them. Then the importance of their repair becomes a top priority. Your main water line, sewer line, and electric service lines are just few examples of utilities you can’t live for a very long time without. Often times you need to fix them immediately, and that can be expensive. That is why you should have the Service Line coverage endorsement for your dwelling.

What does it cover?

Service line coverage is designed for underground water lines, sewer lines, electrical lines, communication lines, and geothermal piping that is a part of your heating and cooling system. These service lines are covered between the city’s utilities and your dwelling. This coverage not only covers the service line that fails, it also covers the cost to excavate your property to make the repairs and to replace landscaping or pavement needed to be removed to make the repairs.

What are the most common types of covered losses?

The most common losses we cover are a collapse or breaking of sewer lines, breakage of water lines, and breakage of electrical lines.

Is there a limit on this coverage?

Yes, service line coverage is limited to $10,000 and comes with a $500 deductible. We have found that the vast majority of claims do not reach our $10,000 limit of coverage.

How can I find out more?

Contact your local Farmers Mutual Agent and ask if you can have this important coverage added to your policy. A listing of agents can be found on our website at fmiahull.com

Boat and Camper Coverage

As the dog days of summer are now in full swing, many of you are out enjoying the great outdoors. This is a great time of year to go camping or take the boat out to the lake. Some of the best vacations I have been on are at the lake. At Famers Mutual Insurance we know that your camper and your boat can be sizable investments.

We are here to protect them and to give you peace of mind when you are on the highway, in the campground, or at the lake.

Common Camping Claims

Common Boat Claims

If you have a place at the lake, you can also insure your boat hoist and/or dock with Farmers Mutual.

We hope you have a great time with your campers and boats, and want to remind you that we can provide the coverage you need for your property.

Check out our webpage at for a list of agents in your area who can help get your property covered with Farmers Mutual Insurance of Hull.

Don’t Get Burned

Every year during the summer months, especially around the Fourth of July, people all over the country celebrate by using fireworks. Fireworks have been with Americans since our nation’s beginning. Early U.S. settlers brought their love of fireworks with them to the New World and fireworks were part of the very first Independence Day – a tradition that continues to this day.

While July 4th is still the “big day”, Americans continue to use fireworks year-round to celebrate at festivals, special events, and sporting traditions such as the Olympics and Super Bowl.

However, it is important to remember that while fireworks are fun, they come with some serious and potentially harmful consequences.

Firework Statistics:

- More than 19,500 property fires are started by fireworks each year

- Every year around 10,000 people are treated in emergency rooms with fireworks-related injuries.

- Children under the age of 15 have the highest rate of firework injuries with 50% of the injuries occurring to the hands, fingers or legs.

- Sparklers account for roughly 25% of emergency room fireworks injuries.

Tips for having a Safe Fireworks Display

1. Skip the Sparklers

They seem a lot safer than aerial fireworks but they are actually quite dangerous especially for kids.

Yes, they look cool but they are also extremely hot.

Sparklers burn at around 2,000 degrees Fahrenheit.

These things could be used in a heist movie to melt metal and it would be scientifically accurate.

You don’t want your children (or yourself, even) holding them.

2. Use only in a Clear open Area

Make sure the area where fireworks are used is clear of dry, potentially flammable grass, wood, or debris. It is also a good idea to monitor your state’s wildfire warnings and make sure there isn’t a fire weather watch in effect.

3. Light fireworks on a flat surface

Using a flat surface is extremely important when using fireworks. If the area where you are using fireworks is too uneven, there is the potential they could tip over and go off horizontally and severely injure someone. Flat surfaces are also important when using fireworks that take off vertically, like bottle rockets. If the area is too uneven, they could have an angled trajectory which could result in an injury to a person, property damage, or fires.

4. Only Adults should use fireworks

The vast majority of firework-related injuries happen to children under the age of 15. Understanding the risks fireworks pose to children and the importance of having adults present to handle fireworks can greatly decrease injuries and deaths.

So, in these coming weeks when you and your family and friends are settling in for your epic do-it-yourself fireworks display, remember these safety tips and have a happy and safe Fourth of July!

Sewer & Drain Coverage

Even though it has been dry this Spring, it is important to remember that it is still Spring. Typically, May and June are some of the wettest months of the year. We know that in Iowa weather patterns can change quickly, and when they do we can get large downpours of rain in a short amount of time. That is when you need your sump pump and foundation drainage system to work at it’s best.

We would like to remind you of a few things you can do to make sure that your sump pump will be working when you need it most

Does Your Pump Turn On?

Simply check to make sure that your pump still turns on. Sometimes pumps that have not needed to pump for a long time actually “freeze up” from rust, corrosion, or scale build up and will not come on when they are needed. To test your pump, simply remove the lid from your sump pit and fill the pit with water to the point that it lifts up the float. If your pump does not turn on and pump out the water, you will need to investigate and see if it is frozen up, the motor is dead, or the breaker is tripped. Taking care of this problem now will insure that your pump is working when you need it.

Will You Know If It Doesn't Turn On?

Consider adding an alarm to your sump pit, or located near your sump pit. A second line of defense of knowing when your pump has failed can be a life saver. Alarms come in all different price ranges and capabilities. I would suggest looking online by searching “sump pump alarm” and finding which one would fit you best. This can be an inexpensive way to prevent expensive damage from an overflow.

Two is Better than One

Consider purchasing a “dual pump” system for your sump pit. This system has two pumps that sit side-by-side and both fit in a standard sized sump pit. The advantage of the dual pumps is that if one pump fails, the second will kick in. This will prevent your pit from overflowing and flooding your basement. Most of these can be purchased for a reasonable price.

Make Sure You're Covered

Make sure you have adequate sewer and drain backup coverage on your homeowners insurance policy. This is an additional endorsement that is not typically included in the base coverages of most homeowner policies.

If you have any additional questions, feel free to call our office at 712-439-1722.

Got Milk? Celebrate Dairy Month!

June is National Dairy Month! For more than 75 years, Americans have been celebrating our love for dairy products. What started out as National Milk month in the 1930s to promote milk consumption has grown into a month-long celebration to acknowledge all the contributions that the dairy industry makes to our lives.

A Few Fun Facts:

Farmers Mutual Insurance works to provide important coverages for our dairy farmers, from coverage on actual dairy cows, to dairy barns & milking parlors and the equipment needed to run a successful dairy operation. We also offer a spoilage coverage to help protect against a loss or contamination of the farmer’s final product, milk!

Join us by celebrating with a sweet treat or a nice cold glass of milk in support of all the dairy farmers and their families who work tirelessly to provide our communities and nation with a delicious and nutritious food.

Happy Memorial Day!

Farmers Mutual Insurance wants to wish you a safe and fun filled Memorial Day!

Memorial Day is often considered the unofficial kickoff to the summer and people typically flock to lakes, barbecues and parties. The American Automobile Association estimates that around 41.5 million Americans on average travel during the weekend.

Over the last 15 years, the number one inland marine loss reported over Memorial Day weekend to Farmers Mutual Insurance have involved cellphones being dropped in a lake or run over by a vehicle.

So, while you are dusting off that boat or camper enjoying the first day of summer, here is a friendly reminder from us at Farmers Mutual to hang onto those cellphones!

This new and improved payment portal can be accessed on the Payment Center tab on our website fmiahull.com. If you have any questions about these new features or need help with registering for an account, you can contact our office and we would be happy to assist you!