FARM COVERAGES

FARM-GUARD® FARM INSURANCE POLICY

We are your partner in protection.

Farmers know a thing or two about uncertainty. Serious injury or product contamination can send an otherwise smoothly running farm operation reeling. That’s why Grinnell Mutual offers Farm-Guard®, a farm liability policy that protects the members of your household in case of an accident, injuries, or claims of negligence. Even better? Farm-Guard® can be attached to your Farm-Mate policy issued by your member mutual or on its own. From premium discounts to optional coverages, Farm-Guard® will ensure that even if your today is hazy, tomorrow will be brighter.

FARM-GUARD® FARM INSURANCE LIABILITY COVERAGE*

- Medical payments to public — Pays for accidental injury to the public on your premises, by your livestock or because of your farming operations or personal acts

- Employers’ liability — If state law doesn’t require Workers’ Compensation, this coverage protects against liability for injuries suffered by your farm employees

- Medical payments to farm employees — Covers medical expenses for accidental injury suffered by your farm employees while on the job, even if you’re not at fault

AUTOMATIC FARM INSURANCE COVERAGES

- Coverage for losses arising out of custom farming or feeding when receipts total less than $5,000**

- Protection from losses arising from business pursuits, except agricultural spraying, when receipts total less than $2,000**

- Contractual liability relating to the farming operations, goods or products, or resident premises

- Personal injury protection against bodily harm, shock, or mental anguish

- Limited coverage for bodily injury caused by communicable disease via animals

** Higher limits are available

OPTIONAL FARM INSURANCE COVERAGES INCLUDE

- Business activities

- Residential rental property

- Home day-care provider

- Hunting and fishing

- Custom farming

- Custom feeding

- Broad contractual liability

- Agricultural custom spraying

IDENTITY THEFT PROTECTION

Grinnell Mutual understands that your most valuable commodity is your good name. That’s why we provide free access to fraud specialists at CyberScout™, a leader in identity management and fraud education.

Contact an agent to find out more about Farm-Guard® insurance.

*Farm liability coverages are not available in the state of Pennsylvania.

_________________________________________________________________________________________

AGRIBUSINESS

We stay ahead of the curve. Whether you’re a seed dealer or own a working ranch, we believe there’s no such thing as a “small” business — it’s a big deal to you and it’s a big deal to us. Grinnell Mutual understands that your livelihood needs tailored, focused coverage you can’t get from a basic agricultural package. And because we know that the rural marketplace is constantly evolving, we offer products that align with the latest in agriculture technology. It’s another way we’re is investing in tomorrow’s farmer.

COMMERCIAL AGRIBUSINESS INSURANCE COVERAGE

- Commercial buildings

- Business personal property

- Inland Marine

- Dwelling

- Personal structures

- Farm buildings

- Household personal property

- Machinery

- Equipment and implements

- Scheduled or unscheduled farm personal property (machinery, equipment, and implements)

OPTIONAL AGRIBUSINESS PROPERTY PLUS ENDORSEMENT

- Newly purchased farm machinery, vehicles, and equipment

- Additional 30 days borrowed or rented farm machinery

- Rental reimbursement on farm machinery

- Disruption of farming operations

- Tank leakage

- Cost of record restoration

- Farm computer and office equipment

- Disruption of farming operations

- Pollutant cleanup and removal

- Computer fraud

- Water backup

OPTIONAL AGRIBUSINESS LIABILITY INSURANCE COVERAGES

- Custom Farming Liability

- Custom Feeding Liability

- Confined Livestock Care, Custody, and Control Liability

Commercial Agribusiness coverage is available in Iowa, Illinois, Indiana, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota, and Wisconsin. All risks must be referred to Grinnell Mutual by the sponsoring agent’s mutual to verify the mutual’s role in the agribusiness account.

Contact an agent to find out more about Agribusiness insurance.

https://www.grinnellmutual.com/insurance/farm/farm-coverages

Announcing the Recipients of the 2023 Farmers Mutual Insurance Service Award Scholarship

Every year Farmers Mutual Insurance sponsors 20 college scholarships for high school seniors whose parents are policy holders and currently attend a local northwest Iowa high school. The purpose of this scholarship is to award those who have a record of academic excellence and service to their community.

We are proud to announce the following recipients for the 2023 Farmers Mutual Service Award Scholarship:

- Jadyn Jensen Sibley-Ocheyedan High School

- Emily TerWee West Lyon High School

- Avery Noble Boyden-Hull High School

- Derek Goth MMCRU High School

- Megan Van Maanen Trinity Christian High School

- Myka Schut Sioux Center High School

- Isabelle Olson MMCRU High School

- Jack Meister Woodbury Central High School

- Kaylee Fluit Central Lyon High School

- Brooklyn Vander Veen Unity Christian High School

- Beau Rasmussen South O’Brien High School

- Frankie Allender River Valley High School

- Leah Langel Gehlen Catholic High School

- Brandt Van Dyke Sioux City East High School

- Jaylee Happe Cherokee Washington High School

- Avery Schroeder Kingsley-Pierson High School

- Hayden Van De Stroet Western Christian High School

- Hannah Pigott Cherokee Washington High School

- Madison Theisen Alta-Aurelia High School

- Kourtney Dekker Sheldon High School

We at Farmers Mutual would like to say congratulations to these astounding high school seniors and wish them the best on their future college endeavors!

Service Line Coverage

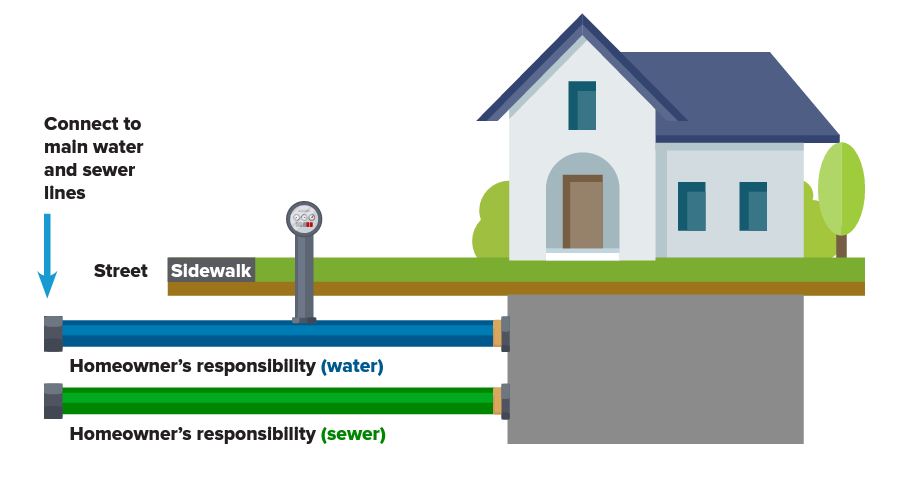

The main utilities running to you and from your home are not something you normally think about until you have a problem with one them. Then the importance of their repair becomes a top priority. Your main water line, sewer line, and electric service lines are just few examples of utilities you can’t live for a very long time without. Often times you need to fix them immediately, and that can be expensive. That is why you should have the Service Line coverage endorsement for your dwelling.

What does it cover?

Service line coverage is designed for underground water lines, sewer lines, electrical lines, communication lines, and geothermal piping that is a part of your heating and cooling system. These service lines are covered between the city’s utilities and your dwelling. This coverage not only covers the service line that fails, it also covers the cost to excavate your property to make the repairs and to replace landscaping or pavement needed to be removed to make the repairs.

What are the most common types of covered losses?

The most common losses we cover are a collapse or breaking of sewer lines, breakage of water lines, and breakage of electrical lines.

Is there a limit on this coverage?

Yes, service line coverage is limited to $10,000 and comes with a $500 deductible. We have found that the vast majority of claims do not reach our $10,000 limit of coverage.

How can I find out more?

Contact your local Farmers Mutual Agent and ask if you can have this important coverage added to your policy. A listing of agents can be found on our website at fmiahull.com